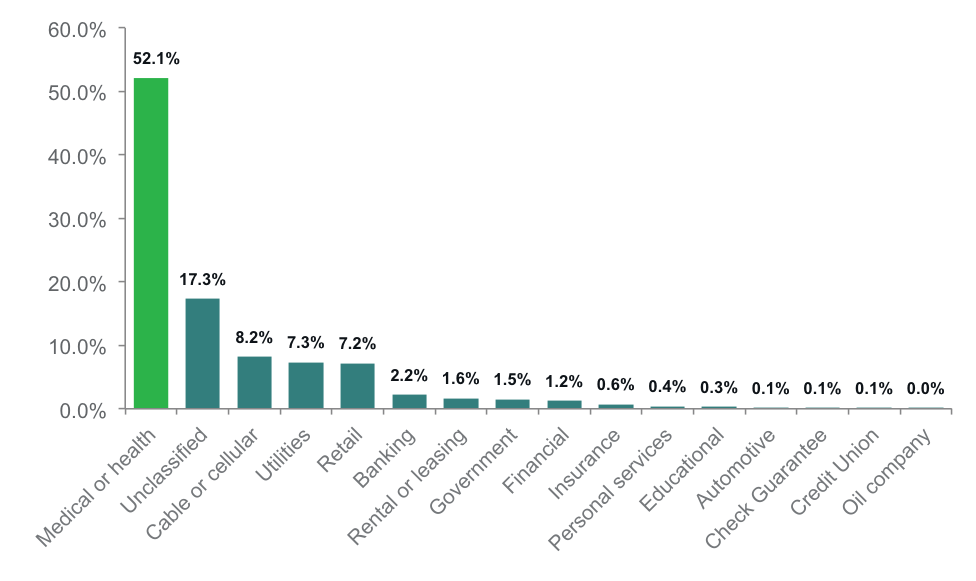

Medical debt on credit reports is a huge problem in the United States. Small medical debts cause large unnecessary harm to the credit rating of millions of Americans. The Consumer Financial Protection Bureau just issued a press release about the problems with medical debts on consumer credit reports. According to the CFPB, over 52% of all collection accounts on credit reports are medical debts. The tragedy is that many, if not most, of these delinquent accounts belong to people who can and do pay their bills. Even a single unpaid bill can be a negative item on your credit report for 7 years - even if later paid - and significantly impact your credit score. The scope of the problem is highlighted by the CFPB's graph showing the preponderance of medical accounts.

I receive a lot of calls from people who are surprised at medical debts showing up on their reports. Medical bills can be confusing, and they come in batches. It is easy for a bill to slide between the cracks, and collectors aren't always diligent about sending collection notices before reporting the debts. Also, consumers often are caught in the middle between their health care providers and their insurance companies. The providers often submit inadequate claims to the insurance companies, and the insurance companies often wrongfully delay or refuse payment.

How to get medical debts off your report

The key to getting these medical bills off your report is to become a letter-writing machine. When a provider or a collection agency puts a medical collection item on your credit report, if it is owed, you can pay the bill, BUT, pay it with conditions. Put in your letter that you are tendering the payment under the condition that they delete the tradeline on the credit report. (A tradeline is the term for the reporting of a single account on your credit report.) If appropriate, you can add in your letter that you are paying a disputed bill (and give the reason) or that it should not have been reported because you did not have the opportunity to pay it earlier. Sometimes it even makes sense to pay a bill that should be covered by insurance. It is penny-wise and pound-foolish to refuse to pay a small bill on principle when it can cost you thousands of dollars in extra credit costs. If you pay a bill the insurance company should have paid, you can always submit it to your insurance company to be reimbursed to you.

If you flat-out dispute owing the bill, you should send a letter VIA CERTIFIED MAIL (keeping a copy) to the medical provider or collector advising them that the bill is disputed and why. You should demand that the tradeline on the credit report be removed or replaced with a notice that the account is "disputed by the consumer". In a couple weeks you should check your credit reports, and if the disputed item is still listed (and not listed as disputed), you should send a dispute through the credit reporting agencies. That usually solves the problem, but if it doesn't, it is time to call a NACA (www.consumeradvocates.org) consumer lawyer because you may have a case for damages under the Fair Credit Reporting Act.

If you can get to the bill before it goes on the report . . .

The best way not to have a problem with medical bills on your credit report is to get to the bill before it is reported. That isn't always possible, but it is sometimes. These bills usually fit these categories: bills you can't pay, bills that are inaccurate or incomprehensible, and bills that are subject to insurance disputes and delays. If you can't pay the bill, it is important to make arrangements with the medical provider as early as possible and ask for payment terms and write-downs based on your ability to pay. Make sure any plan given is backed up in writing. If bills are inaccurate or incomprehensible, you need to advise the provider of the problem in writing and send a copy of your dispute to the insurance company. In most cases you are supposed to receive a letter from a collection agency advising you that you have 30 days to dispute the debt before further collection actions occur, including the action of putting it on your credit report. You need to take these letters seriously and send a dispute letter to the collection agency in writing, in a form that you can prove the agency received such as by fax with confirmation or certified mail. No disputed account should go on your credit report as an undisputed debt.

How to handle insurance problems

For the bills that the insurance company should pay but doesn't, you need to write the healthcare provider and advise them to withhold reporting while you work it out with the insurance company. If you contact your healthcare provider soon enough, the provider might not send the bill to collections in the first place. You need to write the insurance company and tell the insurer why the bill should be paid. If the insurance company says the provider did not submit the appropriate claim, you need to forward your insurance correspondence to the provider advising them to keep working on the claim. In some cases, if the healthcare provider is a member of a preferred provider network, the provider is contractually obligated to go through a dispute procedure with the insurance company rather than billing you directly. If your insurance company unreasonably withholds payments, you can and should file an administrative complaint. For private insurance that you acquire directly, you can complain to your state's insurance commission. For medicare and medicaid, there is a claims denial process, and a complaint process. For government-backed plans, you can also file a complaint with with the constituent services office of your congressional representative. For insurance that you receive through work (ERISA), the official complaint path goes through the United States Department of Labor Employee Benefits Security Administration, an agency that I have found is pretty close to useless. Another avenue for complaints is through your benefits representative at work, which is especially useful if you are in a union. Remember to make your complaint in writing and include documentation.

Negotiating discounts

Some bills you can negotiate a discount with the collection agency. When you bargain to a discounted amount, you should make it a specific term of the deal that in exchange for the payment, the collection agency agrees to delete the tradeline. When you submit the payment, you should include reference to the agreement to delete the tradeline in your cover letter accompanying the payment (keeping a copy, naturally). Often the collection agencies say they can't or aren't supposed to bargain to delete tradelines. They often do it anyway. There is no law saying any creditor has to report any debt. There might be a contractual agreement between a collector and a credit reporting agency not to settle debts in exchange for an agreement to delete the tradeline; but that's not your problem. Whenever you are negotiating with a collection agency, you need to convince them that the money you are giving them is money that they would never be able to get otherwise. If you are married, you should let them know that you are basing your offer on the income of the person who received the services and not the other spouse. If your entire income is social security, tell the collector that. Most collectors know they can't garnish social security, so they will usually be very reasonable with terms. I strongly discourage making payment plans with debt collectors. They rarely give you a good deal, and it just sets you up for hounding calls. Wait until you have a lump sum to offer; make your offer and stick to your guns.

HIPAA

Finally, there is the issue of HIPAA privacy. Some medical collection items on credit reports come from providers whose very names broadcast private information about your health. You can object to the inclusion of these tradelines on your credit reports with disputes to the credit reporting agencies.

As a side note, any time you dispute anything with the credit reporting agency, do it in writing, by letter, and keep a copy. If it is an important dispute that you don't want to have to do over, send it by certified mail. DO NOT use the agency's telephone or internet dispute mechanism because there is no good evidence to track your dispute.

The good news about health care collections on your credit report is that these are among the easiest credit reporting problems to solve if you are diligent with your letters. The bad news is that it takes a lot more time and hassle than it should. The new Consumer Financial Protection Bureau has recognized the problem, and it is working on regulations to make the process more fair. Until this regulatory response is in place, there is no substitute for your own efforts, backed up by a consumer lawyer when necessary. The CFPB is interested in hearing your story and handles complaints regarding the reporting of medical (and other) debt. You can contact the agency through this link.

A blog covering legal topics and whatever I feel like posting. Some posts on this page could be considered to be attorney advertisements.

About The Consumer Law Office of Steve Hofer

Steve Hofer has been practicing consumer law in Indiana for more than 20 years. He is a former Indiana State Chairperson of the National Association of Consumer Advocates, a national organization of attorneys striving for fairness in the consumer marketplace. Contact me by phone at 317-662-4529 or via email at hoferlawindyATgmail.com. You can also leave a message through my website at www.hoferlawindy.com.

Subscribe to:

Post Comments (Atom)

Thanks for shearing about on Handle Medical Debt Problems on Your Credit Report this is very important post an exclusive post I like this post.Thanks for shearing.

ReplyDeleteMedical Collections

Are you looking for an alternative to online loans? Personal loans without credit check from Short term credits is the best loan type suitable for you

ReplyDelete